Protecting our clients is our primary goal, for this reason profittide provides important assurances to make trading with us even more secure.

Balance Protection

We protect all our clients against loss of funds.

Segregated Accounts

Your funds are securely held in a segregated client account.

Additional Security

Our additional insurance protects our clients’ capital up to $50,000,000.

Balance Protection

The interests of our clients are our primary goal, so thanks to profittide you will never lose your funds

Our team of specialists takes care to minimize the risk of losing funds to ZERO

The balance protection is open to all clients.

Segregation Of Client Funds

profittide (Nassau)

As a regulated firm, profittide must comply with all rules and directives set by the Security Industries Act. In respect to Client Assets, PART VII indicated that a company must arrange adequate protection for client assets when it is responsible for them. In the event of insolvency of the company, funds are protected as they are held on segregated accounts which are separate from E-bite funds.

The Securities Industry Regulations (SIR), that coincides with the Securities Industry Act, sets out various rules and procedures that must be followed. Among these rules are the guidelines on how to deal with client assets. These include the requirements, methodology and records, reconciliation and acknowledgement of trusts.

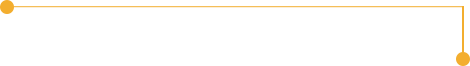

Client Fund Insurance

profittide

Client funds individually covered up to USD50,000,000

profittide is a leader in providing additional and extensive protection directly to its customer base and is proud to offer the security and peace of mind of insuring its clients ’funds as standard, with no extra cost to you.

Clients of profittide are individually covered up to $50,000,000 with Excess of Loss Insurance. The security of our clients ’funds is important to us and therefore we may be able to increase the maximum amount covered according to an individual client’s needs (Terms and Conditions will apply).

What is Excess of Loss Insurance?

profittide has purchased, at no direct cost to clients, separate insurance protection to cover losses, if there is an insolvency event, in excess of $2,000 and up to $50,000,000. The profittide Excess of Loss Insurance Policy is subject to Terms and Conditions and will respond only in the event that certain conditions are met.

How much insurance has profittide purchased?

profittide has purchased an aggregate limit of insurance that exceeds the exposed capital (client funds greater than $2,000) up to $1,000,000 per client.

Does it cost me anything?

profittide has purchased this insurance policy for your benefit and there is no direct cost to you.

Am I eligible?

profittide’s Excess of Loss insurance is available to all our retail clients.

Who underwrites this policy?

This policy is underwritten by AVIVA.

Who is covered?

All clients of profittide whose funds are held in segregated accounts.

How does this benefit me?

Those customers that deposit more than $2,000 with profittide can now benefit from an insurance policy that protects their funds over and above this amount. profittide is a leader in providing such additional and extensive protection directly to its customer base. With profittide your funds may be protected up to a sublimit of $50,000,000.

The Insurance Certificate

We are a reliable business partner. Our business structure is clear and able to generate high profits for its investors thanks to the use of our experience and our proprietary bots. At the same time, each investment made on our portal by our client is protected by our modern security and encrypted connection for which the Sectigo company is responsible. The insurance policy we offer additionally increases the credibility and increases the safety of our investors.